Insights into Jefferies Group (Trades, Portfolio)'s Latest 13F Filing and Its Impact on the Portfolio

Jefferies Group (Trades, Portfolio), under the leadership of CEO Richard Handler since its acquisition by Leucadia National in 2013 and subsequent renaming in 2018, continues to make strategic investment decisions based on a value investing philosophy. The firm focuses on acquiring distressed and undervalued companies, enhancing their value, and achieving profitable exits. Jefferies operates across diverse sectors, including investment banking, healthcare, real estate, and more, aiming to buy low and sell high without overpaying.

Summary of New Buys

Jefferies Group (Trades, Portfolio) expanded its portfolio by adding 377 new stocks in the first quarter of 2024. Noteworthy new additions include:

- Golar LNG Ltd (GLNG, Financial) with 1,872,202 shares, making up 0.43% of the portfolio and valued at $45.05 million.

- Atmus Filtration Technologies Inc (ATMU, Financial) with 1,056,303 shares, representing 0.33% of the portfolio, valued at $34.07 million.

- SPDR Portfolio High Yield Bond ETF (SPHY, Financial) with 1,196,282 shares, accounting for 0.27% of the portfolio, valued at $28.06 million.

Key Position Increases

During the same period, Jefferies Group (Trades, Portfolio) increased its stakes in 272 stocks, including:

- Visa Inc (V, Financial), where an additional 455,139 shares were purchased, bringing the total to 465,294 shares. This represents a 4,481.92% increase, impacting the portfolio by 1.21% and valued at $129.85 million.

- SPDR Biotech ETF (XBI, Financial), with an additional 612,688 shares, bringing the total to 808,661 shares. This adjustment represents a 312.64% increase, valued at $76.73 million.

Summary of Sold Out Positions

Jefferies Group (Trades, Portfolio) completely exited 383 holdings in the first quarter of 2024, including:

- Surgery Partners Inc (SGRY, Financial), where all 4,563,265 shares were sold, impacting the portfolio by -0.98%.

- Landcadia Holdings IV Inc (LCA, Financial), with all 6,250,000 shares liquidated, causing a -0.43% impact on the portfolio.

Key Position Reductions

Significant reductions were also made in 380 stocks, notably:

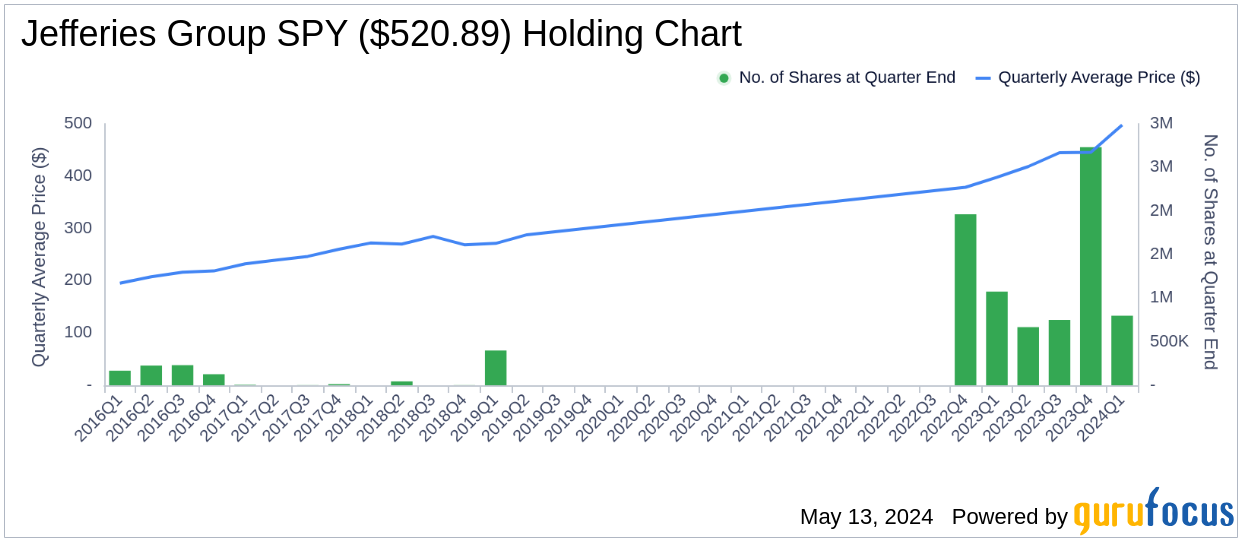

- S&P 500 ETF TRUST ETF (SPY, Financial), reduced by 1,932,768 shares, resulting in a -70.77% decrease and a -6.14% portfolio impact. The ETF traded at an average price of $497.86 during the quarter, with a 5.39% return over the past three months and 9.55% year-to-date.

- Invesco S&P 500 Equal Weight ETF (RSP, Financial), reduced by 622,970 shares, marking an -83.62% decrease and a -0.66% portfolio impact. It traded at an average price of $160.58 during the quarter, with a 5.51% three-month return and 5.21% year-to-date.

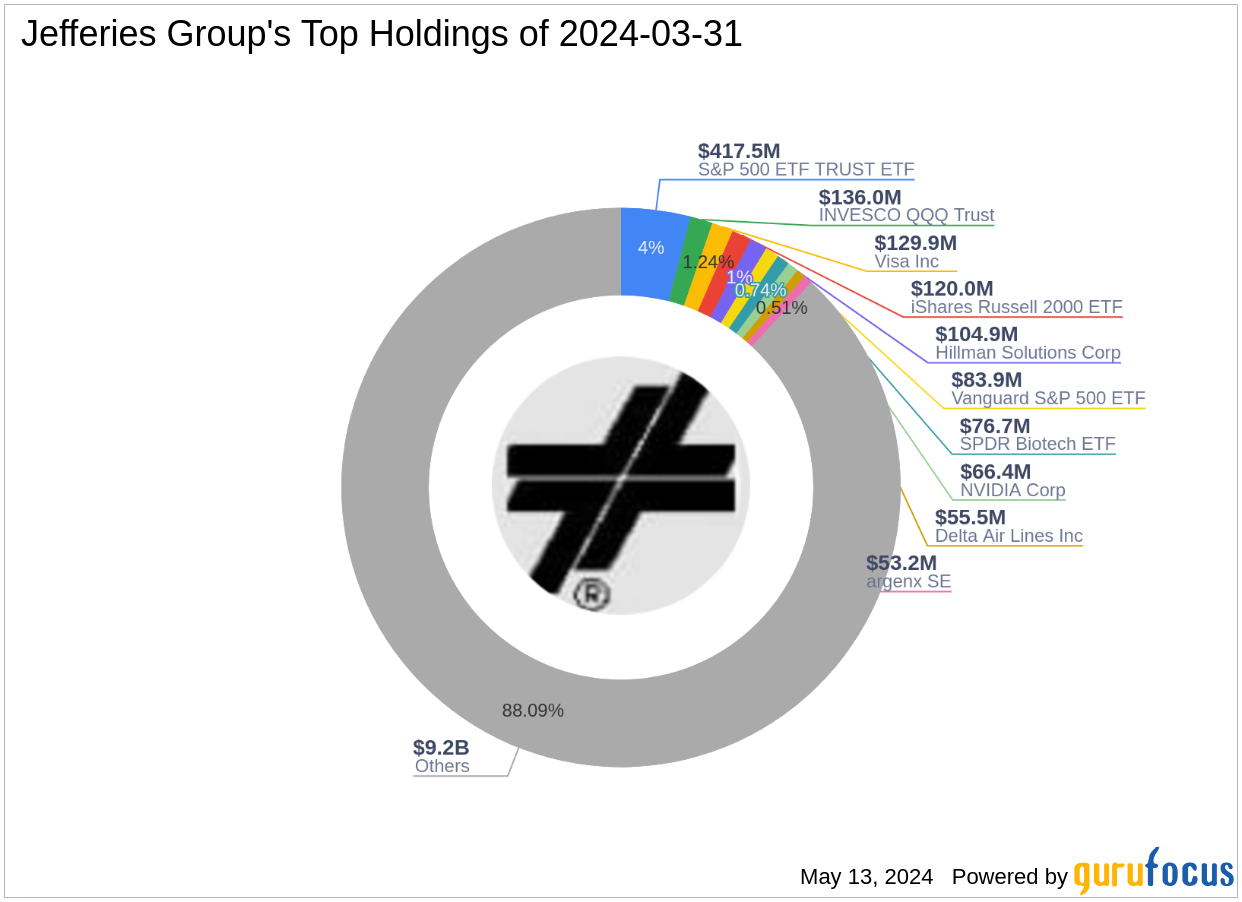

Portfolio Overview

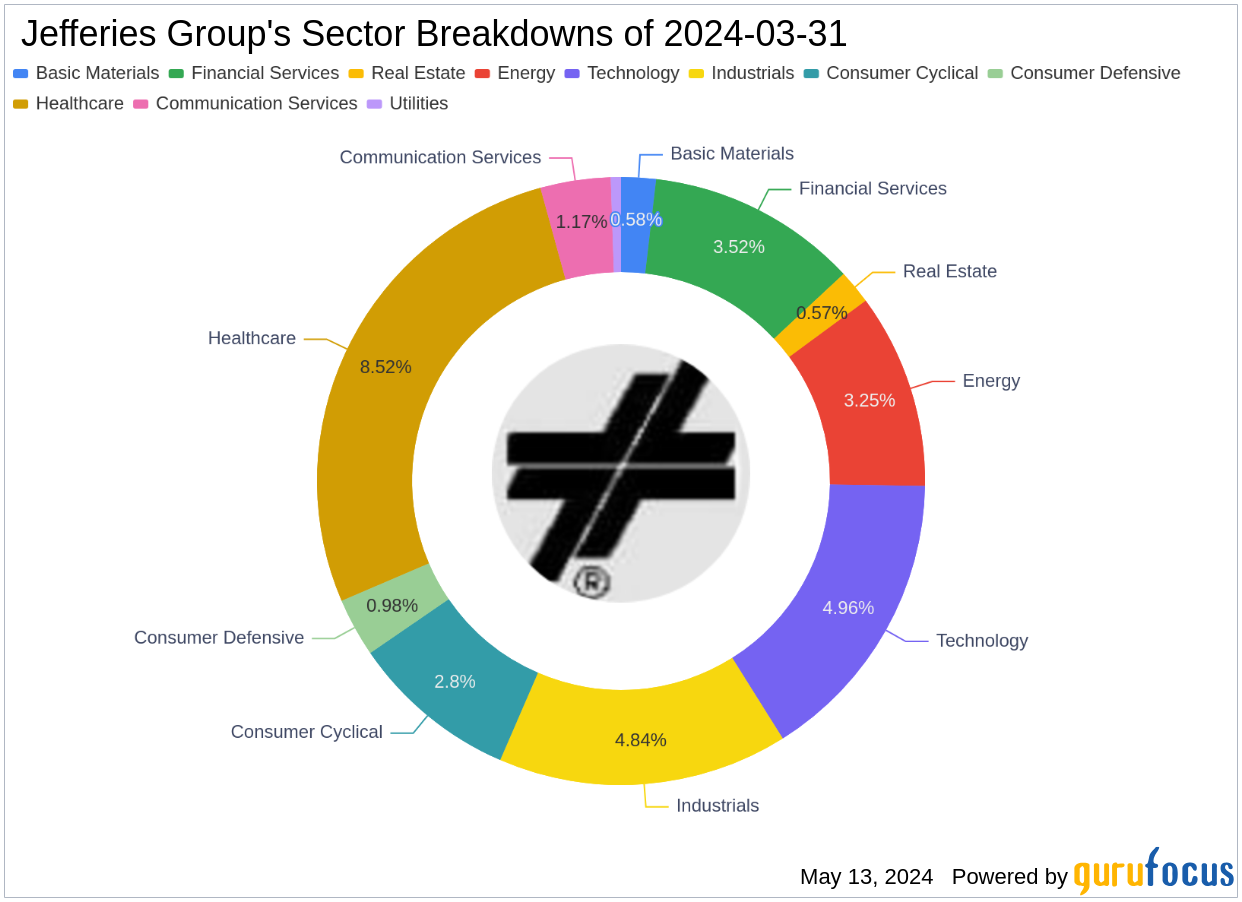

As of the first quarter of 2024, Jefferies Group (Trades, Portfolio)'s portfolio included 1,414 stocks. The top holdings were 4% in S&P 500 ETF TRUST ETF (SPY), 1.3% in INVESCO QQQ Trust (QQQ, Financial), 1.24% in Visa Inc (V, Financial), 1.15% in iShares Russell 2000 ETF (IWM, Financial), and 1% in Hillman Solutions Corp (HLMN, Financial). The holdings are predominantly concentrated across 11 industries, reflecting a diverse and strategic allocation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.